Almost all small businesses benefit by hiring a payroll service due to the added security the companies provide. Many payroll providers offer a assure that their customers’ payroll might be one hundred pc correct and that they may adjust to all payroll tax, filling, withholding and different regulatory obligations. Payroll processing is a core business process that impacts nearly all other features of your operation, but it might be a costly mistake for a enterprise to buy payroll options they don’t want.

Month-to-month Payment

Apart From, QuickBooks does not mechanically process local taxes; you need to do this manually at your finish. All the payroll providers in our rankings calculate and file your business’s payroll taxes, and lots of pay the taxes mechanically. Most of the small enterprise payroll providers we reviewed combine payroll processing with some degree of benefits administration. Distributors similar to Gusto and Rippling bundle their payroll and HR providers, while others, corresponding to Wave Payroll and Justworks, focus primarily on payroll and offer meager HR performance. Each January brings a raft of latest tax laws, many of which affect a business’s payroll tax obligations. Running afoul of tax rules can lead to hefty penalties being levied against your company.

- We gather in depth information to slender our greatest record to reputable, easy-to-use products with stand-out features at an affordable worth point.

- Quickbooks has a easy pricing mannequin you could regulate on a sliding scale on the internet site to see how much the service will price you.

- As we noted in our in-depth Gusto review, that option is available only as an add-on to its basic plan.

- Processing payroll happens rapidly so getting funds to your employees isn’t a stalled course of that takes several days with other payroll suppliers.

- The PEO companies from Justworks don’t permit you to create custom pay schedules or course of ideas, each of which are included with the company’s normal Payroll plan.

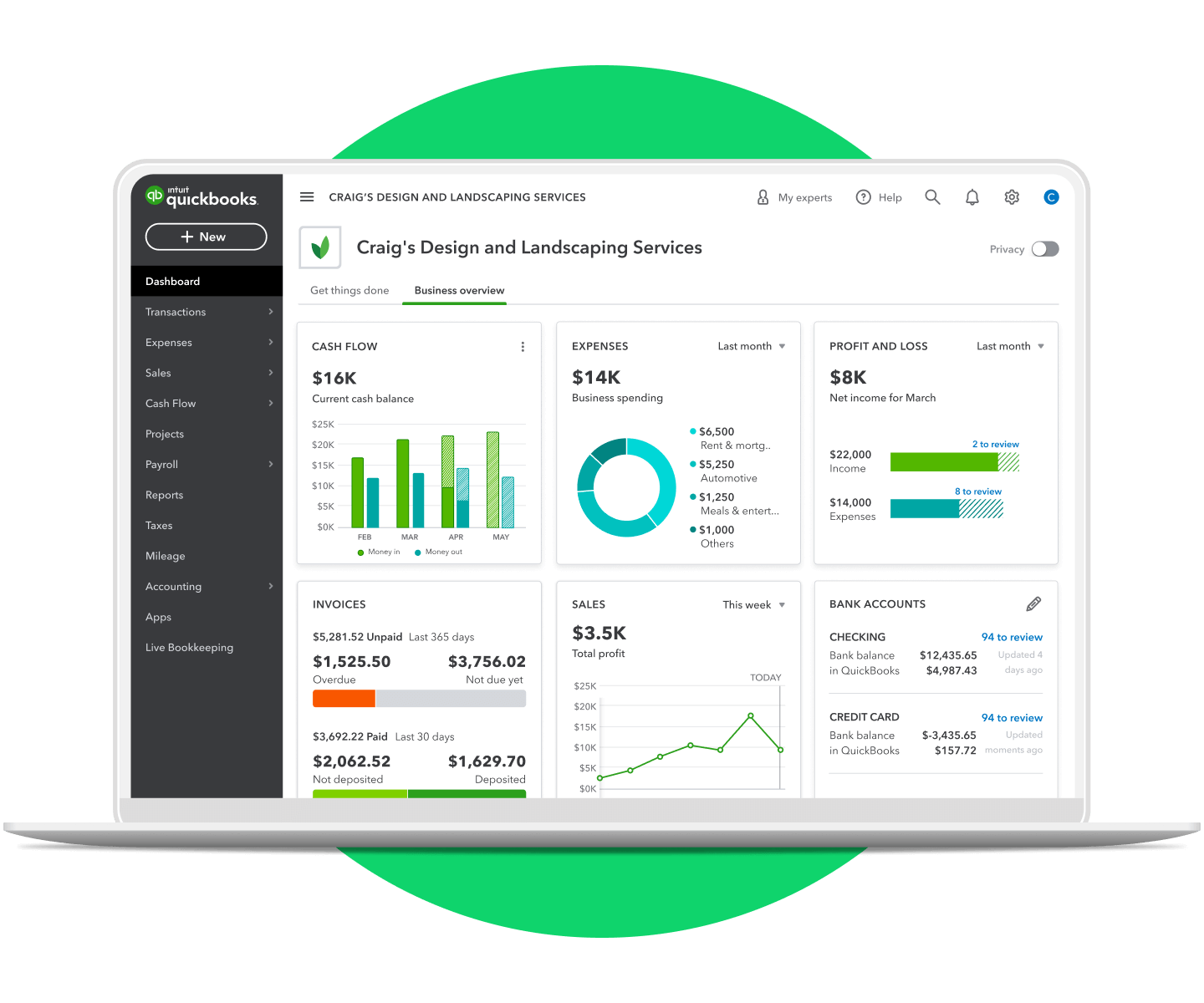

The QuickBooks cell app is intuitive and permits complete management across all gadgets which connect with a user’s On-line Account. There is also a QuickBooks Desktop model available for these wanting to maintain their payroll on a local server. Martin Lunendonk is a senior tech writer specializing in web site builders, hosting, and ecommerce platforms. QuickBooks Payroll prioritizes safety and employs superior measures to safeguard delicate data. The software program ensures compliance with trade standards and supplies common updates and security patches to enhance quickbooks payroll review its reliability, making it a safe alternative for companies dealing with payroll information.

QuickBooks Payroll has some 20 reports, corresponding to payroll billing summary, payroll deductions and contributions, payroll tax liability, complete pay, workers’ compensation, and so forth. You can customize to add or delete the columns that you really want within the stories before working them. If you mark a report as a favorite, you probably can entry it in a single click the next time.

If you might have the Core plan, you’ll obtain free next-day direct deposit; Premium and Elite packages ship direct deposits the identical day you process payroll. Quick direct deposits let you hold onto money longer, which helps with money flow strategies. QuickBooks Payroll additionally helps popular alternatives to direct deposit like pay playing cards. Payroll software can prevent time and money by automating tax submitting, direct deposit and employee self-service. It can even assist you to handle your payroll, HR, advantages and talent from a single platform.

Moreover, long wait times are reported when calling customer support. One of the elements I respect most about QuickBooks Payroll is its seamless integration with QuickBooks accounting software. This integration allows for environment friendly financial management, decreasing the necessity for guide knowledge entry.

It has just lately included live assist into its QuickBooks On-line plans. Selecting to skip the 30-day free trial allows you to access one-time stay setup assist inside the first 30 days. A QuickBooks professional will information you thru the entire setup process, including connecting your financial institution accounts and credit cards, setting up automation, and sharing finest practices. The Elite package is probably the most premium of QuickBooks’ payroll choices. A bonus with the Elite plan is that companies get tax penalty protection. This signifies that QuickBooks will cover users’ IRS penalties as a lot as $25,000 per year, if essential.

They responded immediately, answered all of our questions and have been personable throughout the dialog.

Why Quickbooks Payroll Is Finest For Same-day Direct Deposit

The setup course of for QuickBooks Payroll could be advanced, particularly for first-time customers. It requires cautious consideration to element in the course of the preliminary configuration. Nonetheless, the step-by-step guides and tutorials offered by QuickBooks might help simplify the method. So after paying $125.00/month for months and months of the Payroll Service add-on, QB Assist despatched me an e mail that they’ve determined my account is high danger and won’t enable me to run payroll.

Best Hr Outsourcing Providers In 2024

A excessive scoring software program reflects https://www.quickbooks-payroll.org/ a excessive web promoter score from present or previous prospects. Rob Clymo has been a tech journalist for more years than he can actually keep in mind, having started out within the wacky world of print magazines earlier than discovering the ability of the internet. In the uncommon moments he’s not working he is often out and about on one of numerous e-bikes in his collection. There’s even a reside chat operate to do this immediately if issues are pressing.

RUN Powered by ADP presents custom pricing based mostly on the business’s measurement and desired options with charges starting at $79 per 30 days plus $4 per worker. In Contrast to QuickBooks Payroll, it integrates with a larger diversity of HR solutions, accounting software program and enterprise resource-planning options. The lowest-tier Important plan additionally consists of new rent onboarding, as nicely as the choice to add time and attendance tracking, retirement plans, workers’ compensation, medical health insurance and advertising assistance.